Introduction

The emergence of ‘tokenised’ finance is opening up new avenues for agricultural and wine cooperatives, particularly through the tokenisation of impact participating securities. Not only does this innovation make it possible to increase the value of their intangible assets, such as brand equity and ESG (Environmental, Social and Governance) capital, it also offers real disruptions in terms of broadening the range of investors and combating greenwashing.

Cooperatives at the forefront of sustainable development, but not always with enough equity ...

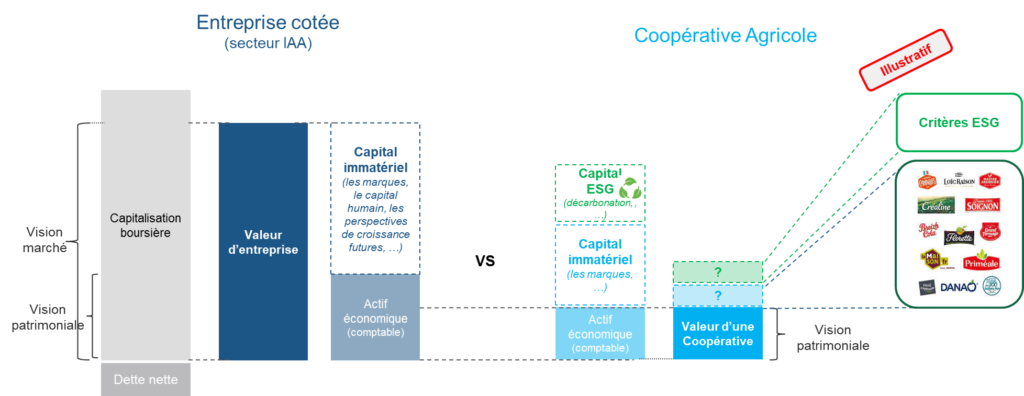

According to Crédit Agricole’s 2020 Observatory, the equity capital of agricultural cooperatives represents 26% of sales, compared with 43% for companies in the agri-food sector (IAA), resulting in lower levels of investment (2% of sales compared with 5% for IAA).

Today, agri-agro cooperatives are hampered in their investments by their lack of equity capital, unlike other agri-food companies, which can leverage their intangible assets by accessing numerous investors on the financial markets or the private debt market. These investments are all the more necessary for cooperatives to face up to the dual transition to climate and energy and to remain competitive.

Cooperatives that are emblems of sustainable capitalism are mainly financed by self-financing and bank loans. For lack of a suitable alternative financing solution or infrastructure, they have access to fewer sources of finance than traditional businesses.

Alternative financing solutions, such as private debt or crowdfunding, are little used because co-operatives are wary of external investors and, conversely, investors are unfamiliar with co-operatives, believing them to be too fragile and, above all, illiquid.

Like shares for traditional companies, cooperatives can use impact participating securities to strengthen their equity capital and to enhance their intangible assets (brands, ESG capital, growth prospects, etc.) while maintaining their cooperative model.

What are impact participating securities?

Participating securities were introduced by Act 83-1 of 3 January 1983 [1] on the development of investment and the protection of savings, to enable public limited companies and cooperatives to raise finance from the public by issuing a non-dilutive “equity” instrument.

Participating securities are financial securities. They belong to the category of debt securities, each representing a claim on the issuer (CMF, art L. 213–0–1).

Issuing participating securities is currently the most effective way of strengthening a co-operative’s equity capital [2]. Participating securities:

- are non-dilutive instruments;

- are part of the equity capital without changing the capital structure;

- do not carry voting rights ;

- are redeemable (if desired by the issuer) after a minimum period of seven years;

- eligible for the 25% reduction in personal income tax for SME cooperatives.

Remuneration comprises a fixed component (>60%) and a variable component (article L 228-36 C.com). The variable portion may include ESG impact criteria (e.g. reduction of the agricultural cooperative’s carbon footprint, local development, etc.), making it possible to create impact participating securities.

The concept of tokenization of a company's assets ?

The tokenization of assets, based on blockchain technology, transforms the rights to an asset into a digital token, thereby ensuring traceability, transparency and greater security of value transfers. The tokenization of assets goes far beyond the simple digitization or securitization of assets. It makes it possible to digitize the protocol for securing the transfer of value between two stakeholders who do not know each other.

This digitalised and secure process opens the way to a host of advantages for companies, offering improved transaction fluidity, reduced transaction costs, increased liquidity and, above all, access to a wide range of investors for a company’s tangible or intangible assets, ranging from equity capital to ESG capital, not forgetting stocks, real estate, brand equity, etc.

Tokenization = a stronger catalyst for the valuation of intangible assets

Agricultural and wine cooperatives often have a rich heritage of intangible assets, such as recognised brands, Appellations d’Origine Contrôlée (AOCs) and certified sustainable practices. Tokenization makes it possible to highlight and add value to these assets, which would otherwise be difficult to quantify. By creating impact participating securities, these entities can capitalise on the value of brands and their commitment to sustainable development, their certifications or their contribution to ESG objectives.

The tokenization of impact participating securities can revolutionize the valuation and financing of cooperatives in the agri-food sector, by ‘reifying’ the brand value and ESG value of an agricultural or wine cooperative beyond its book value, without calling into question their governance and cooperative model.

In the same way as capitalising a company, tokenization can be used to enhance the value of a cooperative ...

Like companies in the agri-food sector, whose capitalisation reflects the value of their brands and intangible assets, cooperatives can use tokenization to offer a faithful representation of their added value. Tokenised participating securities act as catalysts for transparency and recognition of the intrinsic value of cooperatives, over and above their book value.

Impact participating securities are attractive to investors

The tokenization of impact participating securities is emerging as an attractive solution for a wide range of investors, both professional and retail. This attractiveness rests on several pillars:

- Best risk/return ratio: Agricultural and wine cooperatives, rooted in the real economy and strongly attached to their local areas, offer remarkable resilience over the long term. Green” participating securities capitalise on this stability while promising competitive financial returns, backed by valuable tangible and intangible assets.

- Positive impact: Investing in impact participating securities makes it possible to combine financial returns with contributions to projects that have a positive environmental and social impact. This is perfectly in line with investors’ growing concern for sustainability and societal impact.

- Confidence and transparency: blockchain technology ensures maximum traceability and security, which is reassuring for direct investors. Direct investors can track the use of their capital in real time and measure the impact of their investment.

Secondary market: Tokenization enables the creation of more dynamic secondary markets for unlisted financial instruments, such as participating securities, which are traditionally very illiquid. By making security tokens accessible on over-the-counter (OTC) trading platforms, this increases the visibility of the instruments and the ease with which potential buyers can acquire them securely and at lower cost.

Challenges overcome and the way forward

Implementing tokenization of financial securities in agricultural and winegrowing cooperatives is not without its challenges. Although the regulatory and tax obstacles have now been removed, the need for a suitable technological infrastructure and raising stakeholder awareness are key steps to be taken.

The law (DDADUE) of 9 March 2023 made two important amendments to Articles L. 211-3 and L. 211-7 of the Monetary and Financial Code, on the terms and conditions for representing listed and unlisted financial securities in a Distributed Ledger Technology (DLT).

However, with developments in the legal framework for security tokens and a growing awareness of the benefits of tokenization, the outlook is promising.

Conclusion

The tokenization of impact participating securities represents an unprecedented opportunity for agricultural and wine cooperatives to enhance the value of their intangible assets, attract diversified capital, and promote greener, more inclusive finance. By successfully navigating regulatory and technological challenges, they can open up a new era of financing and recognition of their real value, benefiting their entire ecosystem.

The innovative approach of tokenization, combined with the strength and resilience of agricultural and wine cooperatives, creates a unique appeal to a diverse spectrum of investors. For both institutional and retail investors, the opportunity to invest in entities that offer not only competitive financial returns but also positive impacts on the environment and society represents a double advantage. This marks a turning point in the way investments can be approached, combining profitability and responsibility in a harmonious way.

[1] Participating securities (or Titres participatifs in french) created by law n° 83-1 du 3 janvier 1983

[2] Senat report – May 2019 – La France, un champion agricole : pour combien de temps encore ?

Originally published at https://www.linkedin.com.